Australia-China relations and Australia’s manufacturing industry – by Katie Howe

The Australia-China political and economic relationship has been under strain with attitudes toughening in Beijing and Canberra. Here China specialist Katie Howe explores what the deteriorating relationship means for Australian manufacturing.

“Australia and the People’s Republic of China, inspired by their longstanding friendship and growing economic and trade relationship since the establishment of diplomatic relations in 1972, have resolved to create an expanded market for goods and services in their territories”.

So begins our 2015 Free Trade Agreement with China.

Designed to improve Australia’s engagement with its largest import and export partner, it highlights the importance of industries such as agriculture, food processing and manufacturing.

By successfully reducing (and even eliminating) specific tariffs, it created opportunities for Australian manufacturers that produce pharmaceuticals, car parts, engines, plastic products, medical technology and aluminium.

Hard to believe that was only five years ago. Particularly considering this year’s chill in bilateral relations.

In 2020, the economic and geopolitical fallout resulting from Canberra’s deteriorating relationship with Beijing has fuelled political debate, media analysis and industry concern.

The impact on beef, barley and wine exports may spread to iron ore, cotton and coal in the coming months.

Yet Australia’s relationship with China is more sophisticated and complex than primary industry exports.

Regardless of our own short-term political and economic cycle, China’s planned economy model has contributed significantly to Australia’s growth and resiliency.

Today, the relationship consists of multiple trade, investment, collaborative research and commercialisation initiatives designed by industry and government to ensure the relevance of our manufacturing industry to China’s key development goals. These include a healthy population, strong consumer market, increased renewable energy use and a net-zero emissions economy by 2060.

Now more than ever, our relationship with China is the turnkey to rebuilding our manufacturing sector. As our largest export and import partner, it contributes to a range of manufacturing industry developments, such as export market, final assembly and advanced technology considerations.

Regardless of which direction the Australian government takes with its largest trading partner, our manufacturing sectors appears to be a key consideration. In fact, the $1.5 billion Manufacturing Strategy released by the Government this month appears to have a foot in both camps – prioritising food, beverage and medical products alongside defence and space infrastructure.

There’s actually a symmetry between the sectors identified by the manufacturing strategy and the initiatives already undertaken by industry-led projects in Australia and China.

These include food processing, beverage brewing/bottling, advanced manufacturing, clean energy and medical products.

Ninety per cent of Australia’s Top Ten importing industries are within the manufacturing sector, producing items relevant to our trade relationship with China – pharmaceuticals, scientific equipment, medical equipment and surgical equipment.

Over the past 18 months, a range of bilateral initiatives have been established or advanced to support these industries.

Monash University founded the largest commercialisation partnership between Australian and Chinese universities, designed to develop medical devices, advanced technology and bio-pharmaceuticals for the international market.

The University of NSW has launched a 5-year joint venture in Shandong province to develop commercial applications in biomedical engineering, renewable energy and advanced manufacturing.

The CSIRO (whose legacy of projects with China dates back 45 years) and Griffith University are working together on a range of technology commercialisation initiatives with counterparts in China.

State Governments have also been active in establishing new initiatives.

The Queensland Government has completed its first round of the Commercialisation Partnership Program, which places Queensland innovators in incubators throughout China to develop technology transfer and/or commercialisation projects (particularly in agriculture, food processing, medical research and renewable energy technologies).

The Victorian Government continues to negotiate with the Chinese government on a range of initiatives, including the development of transport infrastructure which has the potential to boost the state’s manufacturing sector.

While Australia is home to many industry organisations, business councils, think tanks and regional trade bodies, its most effective resource are the specialists within its own workforce.

Economic analysts and industry leaders consistently reinforce the importance of strategic planning, collaboration and regional engagement – areas in which our existing talent base excels.

For four generations, the Australian workforce has heeded the call to develop regional engagement skills that are directly relevant to our largest trading partner.

Each of our major cities are home to an untapped resource – multicultural Australians, returned expatriates, recently graduated international students – that offer market-ready skills. Now’s the time to finally utilise them.

Katie Howe is the owner of Canberra-based agency Jacaranda Communications. She advises manufacturing clients on media relations, CEO profiling, B2B communications, stakeholder engagement, grant applications and lobbying support.

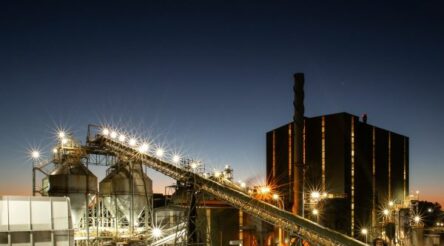

Picture: Katie Howe

Subscribe to our free @AuManufacturing newsletter here.

@aumanufacturing Sections

Analysis and Commentary Awards Defence Manufacturing News Podcast Technology Videos